Holders Zhaobangji Lifestyle Holdings Limited (HKG: 1660) shares would be relieved that the share price has increased by 30% in the last thirty days, but it needs to continue to repair the recent damage it has caused to the portfolios of investors. Not all shareholders will be happy, as the share price has fallen by a disappointing 30% in the last twelve months.

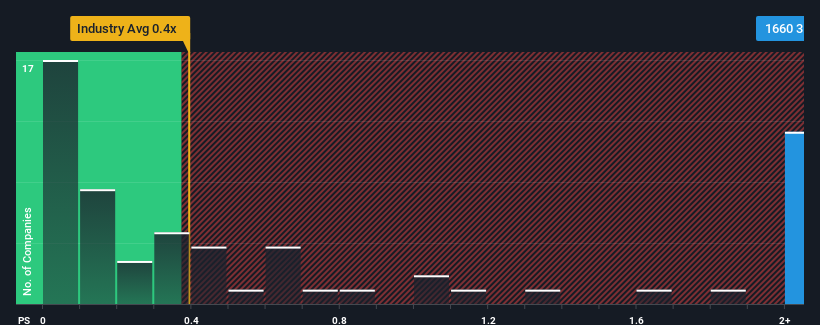

After the price’s sharp decline, you could be forgiven for thinking that Zhaobangji Lifestyle Holdings is a stock to avoid with a price-to-sales (or “P/S”) ratio of 3.4x, at considered about half of the companies in Hong. Kong’s Trade Distributors industry has a P/S ratio of less than 0.4x. However, it is not wise to take P/S at face value as there may be an explanation for why it is so high.

Check out the latest analysis of Zhaobangji Lifestyle Holdings

What Does Zhaobangji Lifestyle Holdings’ P/S Mean for Shareholders?

Recent earnings growth at Zhaobangji Lifestyle Holdings would have to be considered satisfactory if not spectacular. Perhaps the market believes that the recent earnings performance is stronger than the industry, which has increased the P/S ratio. You can hope so, otherwise you are paying a very high price for no reason.

Looking for a complete picture of earnings, revenue and cash flow for a company? Then ours for free report on Zhaobangji Lifestyle Holdings will help shed light on its historical performance.

Are Earnings Forecasts Consistent with High P/S Ratios?

The only time you can really be comfortable seeing a P/S as steep as Zhaobangji Lifestyle Holdings’ is when the company’s growth is on track to outpace the industry by a margin.

Looking back, we see that the company managed to grow revenue by an effective 3.6% last year. Revenue is also up 11% overall from three years ago, thanks in part to the last 12 months of growth. So we can start by making sure that the company has really done a good job of raising money during that time.

Compared to that and the industry, which is predicted to deliver 21% growth over the next 12 months, the company’s pace is weak, based on the latest annual revenue results.

Because of this, it is alarming that Zhaobangji Lifestyle Holdings’ P/S sits above most other companies. It seems that many investors are ignoring the recent weak growth rates, and are hoping for a change in the company’s business prospects. There is a good chance that existing shareholders are bracing themselves for future disappointment if the P/S falls to levels based on recent growth rates.

Details below Zhaobangji Lifestyle Holdings’ P/S

The strong increase in the share price has led to Zhaobangji Lifestyle Holdings’ P/S also rising. Normally, we would caution against reading too much into price-to-sales ratios when making investment decisions, even though it can reveal a lot about what other market participants think about a company.

Our analysis of Zhaobangji Lifestyle Holdings revealed its negative three-year earnings trends do not lower the P/S as much as we do, as it looks worse than current industry expectations. We are currently not comfortable with a high P/S as this earnings performance is unlikely to support such a view in the long term. Unless conditions improve significantly in the medium term, it is very difficult to accept the share price as reasonable.

Moreover, you should learn about them 2 warning signs we saw about Zhaobangji Lifestyle Holdings (including 1 potentially dangerous).

If you You are not sure about the business strength of Zhaobangji Lifestyle Holdingswhy not check out our list of stocks with solid business fundamentals for some companies you may have missed.

Pricing is complicated, but we’re here to make it simple.

Find out if Zhaobangji Lifestyle Holdings Holdings may be undervalued or overvalued with our comprehensive analysis, featuring fair value estimates, potential risks, dividends, insider trading, and its financial position.

Access Free Analysis

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

#Zhaobangji #Lifestyle #Holdings #Limited #HKG1660 #Stock #Rockets #Investors #Spontaneous #Expected